The global in-circuit test market is estimated to reach nearly US$ 1.1 Bn in 2022, registering growth at a CAGR of 5%. Total sales of in-circuit tests are projected to surpass US$ 1.8 Bn by 2032, reports Fact.MR.

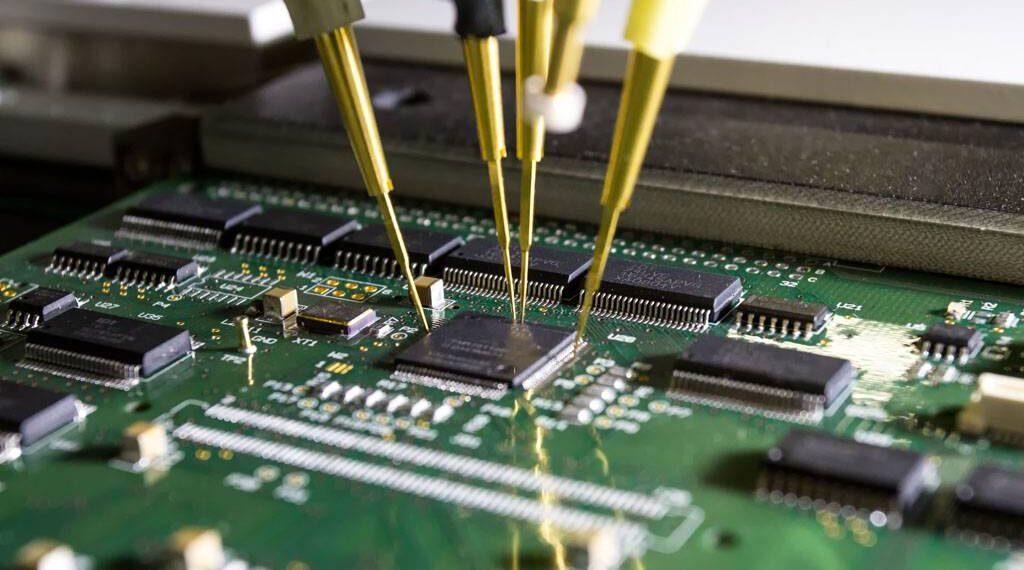

Increasing use of printed circuit boards (PCBs) in consumer electronics, cloud computing, telephony, and IoT devices is projected to augment the demand for in-circuit test.

Also, rising adoption of in-circuit tests to detect electromagnetic disturbances in electronic components is projected to increase sales across various industries including medical equipment and wireless communication systems.

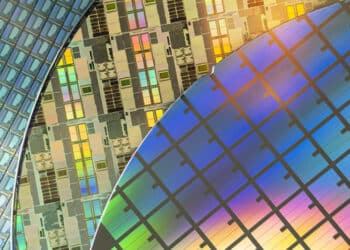

Subsequently, growing usage of high-density interconnect (HDI) technology for the assembly of PCB is estimated to create lucrative opportunities for the in-circuit test market players.

Rising need to identify flaws in the components of PCBs to reduce maintenance cost and to improve product efficiency is expected to increase sales in the market.

In addition to this, growing demand for smart home appliances and digital devices such as mobile phones, tablets and wearables is boosting the applications of in-circuit tests to improve the efficiency of these products. This is anticipated to fuel the growth in the market over the assessment period.

Besides, to eliminate the potential risk of damage to the board caused by misaligned placement in the manufacturing sector is likely to propel the usage of in-circuit tests in the forthcoming years.

Key Takeaways:

- By portability, the compact segment is estimated to dominate the market, exhibiting growth at 4.6% CAGR.

- Based on application, the consumer electronics segment is predicted to hold maximum share in the market, with sales growing at a CAGR of 4.6%.

- Asia Pacific is estimated to exhibit significant growth due to rising sales of consumer electronics in countries such as India, China, and South Korea.

- North America is expected to lead the market owing to the expansion of the automotive, aerospace, and defense sector in the U.S.

Growth Drivers:

- Growing demand for phones, TVs, laptops, and other consumer electronic products increases the need for faultless PCBs. This, in turn, is expected to drive sales of in-circuit tests.

- Increasing adoption of cloud computing and the Internet of Things (IoT) is propelling the application of HDI technology for PCBs assembled in connected devices. This will continue spurring demand for in-circuit tests.

Restraints:

- Lack of standardization in connecting protocol is projected to restrain the demand for in-circuit test.

- Increasing variation in prices of raw materials used in the in-circuit test is anticipated to limit sales in the forthcoming years.

Competitive Landscape:

Leading players in the global in-circuit market are focusing on advancing their manufacturing processes to gain competitive edge as well as to increase their profits. In addition to this, they are also improving their product line to strengthen their global footprint.

Some of the key players are entering into inorganic strategies such as collaborations, acquisitions, and partnerships to expand their business in the forthcoming years.

For instance:

- February 2020: Test Research, Inc. (TRI), which is a leading provider of test and inspection systems, received the IPC APEX EXPO 2020 Innovation Award for its Multicore In-Circuit Tester named “TR5001 SII Inline LED.”

- September 2019: Test Research Inc. developed a new PCB assembly testing and inspection solution that combines functional tester (FCT), 3D CT automated x-ray inspection (AXI), 3D solder paste inspection (SPI), 3D automated optical inspection (AOI), and high-performance in-circuit testing (ICT).