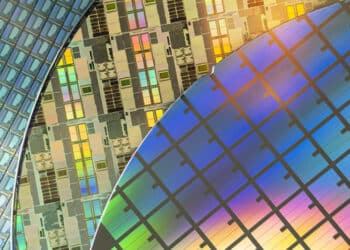

The feature-rich semiconductor manufacturing company, GlobalFoundries (GF) (NASDAQ: CHRT) announces the pricing of its IPO of 55,000,000 ordinary shares, 30,250,000 of which are being offered by GF and 24,750,000 of the remaining are being offered by GF’s existing shareholder, Mubadala Investment Company PJSC, at an IPO price of $47.00 per share.

Mubadala has granted the underwriters a 30-day option to purchase up to an additional 8,250,000 ordinary shares at the IPO price, less underwriting discounts and commissions.

The shares are expected to begin trading on the Nasdaq Global Select Market on October 28, 2021 under the ticker symbol “GFS.” The offering is expected to close on November 1, 2021, subject to customary closing conditions.

Morgan Stanley, BofA Securities, J.P. Morgan, Citigroup and Credit Suisse are acting as active book-running managers for the offering. Deutsche Bank Securities, HSBC and Jefferies are acting as additional book-running managers for the offering. Baird, Cowen, Needham & Company, Raymond James, Wedbush Securities, Drexel Hamilton, Siebert Williams Shank and IMI – Intesa Sanpaolo are acting as co-managers for the offering.