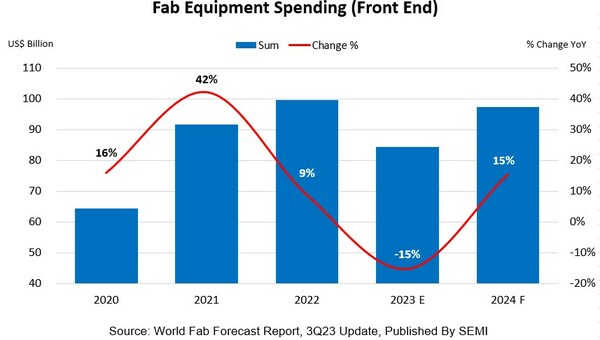

In a recent quarterly report, SEMI, the global industry association representing the electronics manufacturing and design supply chain, has projected a year-over-year decline of 15% in global fab equipment spending for front-end facilities in 2023, amounting to $84 billion. This decrease comes after a record high of $99.5 billion was reached in 2022. However, SEMI predicts a subsequent rebound in 2024, with a 15% year-over-year increase to $97 billion.

The decline in equipment investment in 2023 is attributed to softened chip demand and an elevated inventory of consumer and mobile devices. SEMI forecasts that the recovery in fab equipment spending for the following year will be driven in part by the conclusion of the semiconductor inventory correction in 2023 and a resurgence in demand for semiconductors, particularly in the high-performance computing (HPC) and memory segments.

Ajit Manocha, President and CEO of SEMI, noted, “The 2023 decline in equipment investment is proving shallower, and the 2024 rebound stronger than expected earlier this year. The trend suggests the semiconductor industry is turning the corner on the downturn and on a path back to robust growth fueled by healthy chip demand.”

Within the semiconductor industry, the foundry segment is expected to lead the expansion in 2023, with $49 billion in investments, representing a 1% growth. In 2024, foundry segment spending is anticipated to reach $51.5 billion, a 5% increase driven by investments in leading-edge and mature process nodes. Memory spending is also expected to stage a comeback in 2024, with a remarkable 65% increase to $27 billion, following a 46% decline in 2023. Specifically, DRAM investments are forecasted to recover from a 19% year-over-year decline in 2023 to reach $15 billion in 2024, marking a 40% annual increase. NAND spending is projected to follow a similar pattern, decreasing by 67% to $6 billion in 2023 but surging by 113% to $12.1 billion in 2024. Meanwhile, investments in MPUs (Micro Processing Units) are expected to remain flat in 2023 and then increase by 16% to $9 billion in 2024.

Taiwan is poised to maintain its global leadership position in fab equipment spending in 2024, with $23 billion in investments, reflecting a 4% year-over-year increase. Korea is projected to rank second in spending, with an estimated $22 billion in investments in 2024, marking a substantial 41% increase compared to the previous year, driven by the recovery of the memory sector. However, export controls are expected to limit China’s spending in leading-edge technologies and foreign investment, resulting in a decline in equipment spending to $20 billion in 2024, despite continuing investments by Chinese foundry suppliers and IDMs in mature process nodes.

The Americas is expected to retain its position as the fourth largest region in terms of spending, reaching a historic high of $14 billion in investments in 2024, signifying a 23% year-over-year increase. The Europe and Mideast region is also anticipated to record substantial investments in the upcoming year, with spending expected to increase by 41.5% to reach $8 billion. Fab equipment spending in Japan and Southeast Asia is forecasted to rise to $7 billion and $3 billion, respectively, in 2024.

These projections by SEMI indicate a complex landscape for fab equipment spending, reflecting ongoing shifts and developments in the global semiconductor industry.