The Power Electronics Market is projected to grow from USD 37.4 billion in 2021 to USD 46.3 billion by 2026 growing at a CAGR of 4.4% during the forecast period, reported MarketsandMarkets. Owing to COVID-19, the power electronics market faced some headwinds for 2020–2021. The use of SiC and GaN has resulted in improvements in the existing semiconductor technologies, such as MOSFETs and IGBTs. Power electronics-based power converters continue to be used in renewable energy systems, which mainly include wind and solar energy systems.

Power IC segment to account for the largest share of the power electronics market in 2021

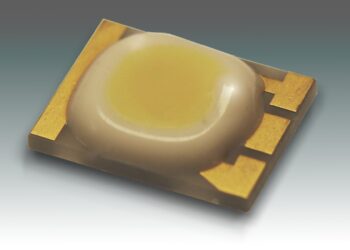

Low power ICs offer high-efficiency and a compact form factor needed for compact applications such as wearables, hearables, sensors, IoT devices, and a wide range of portable devices, such as mobile phones and other portable electronics. Power ICs are also used for DC-to-DC conversion, battery charging, and voltage scaling that have several uses across various industries. Hence, the market for power ICs is expected to hold the largest share of the market throughout the forecast period.

Silicon-based power electronics to dominate power electronics market during the forecast period

Currently, silicon serves as the substrate of choice for a large majority of semiconductor wafers. Silicon-based power electronics are also suitable for low-power applications and applications that do not require a wide bandgap. As silicon is a widely available material used to manufacture a large number of power electronics, it has the highest market share.

Consumer electronics vertical to register the highest share for power electronics market in 2021

Since the introduction of transistors, the power electronics market has been primarily driven by consumer technology. Therefore, the consumer electronics segment is expected to have the largest market share during the forecast period. The growing use of consumer electronic devices, such as smartphones, tablets, and smart wearables, especially in developing countries, is expected to drive the market for power electronics. The increasing adoption of power electronics in home appliances is also expected to contribute to the market size of the consumer electronics segment. China- and South Korea-based OEMs such as Oppo, Xiaomi, Vivo, Meizu, Samsung, and Huawei are adopting GaN-based power electronics for high power inbox chargers for phones as well as accessory fast chargers.

The globally integrated automotive industry is projected to experience the largest impact during the forecast period. Factory closures, supply chain disruptions, and the lack of buyer confidence have negatively impacted the demand for power electronics in the automotive segment. The consumer electronics industry has also been affected as a result of the slowdown in electronics production resulting from the decline in the automotive industry.

Market in APAC estimated to have the largest share during the forecast period

APAC is estimated to lead the power electronics market and register the highest CAGR during the forecast period. The market’s growth in APAC is attributed to the large presence of consumer electronics, ICT, industrial, and automotive verticals across China, Japan, and South Korea. The increasing need for power generation and government initiatives in various countries to promote renewable energy infrastructure are also driving the overall market in APAC. The increasing population in developing countries, such as China and India, leading to the increased deployment of communication infrastructure, is expected to boost the market growth for power electronics. The presence of several well-established power electronics players, such as Renesas Electronics, Mitsubishi Electric, Fuji Electric, ROHM, and Toshiba, contributes to the regional market’s growth. Emerging Chinese players, such as BYD, Huawei, CRRC, and Sungrow, are helping China in strengthening its domestic market for power electronics. These factors are expected to contribute to the growth of the power electronics market in APAC.

Major vendors in the power electronics market include Infineon Technologies (Germany), ON Semiconductor (US), STMicroelectronics (Switzerland), Mitsubishi Electric (Japan), Vishay Intertechnology (US), Fuji Electric (Japan), NXP Semiconductors (Netherlands), Renesas Electronics (Japan), Texas Instruments (US), Toshiba (Japan), ABB (Switzerland), GaN Systems (Canada), Littelfuse (US), Maxim Integrated (US), Microchip (US), ROHM (Japan), SEMIKRON (Germany), Transphorm (US), UnitedSiC (US), and Wolfspeed, A Cree Company (US), Euclid Techlabs (US), GeneSiC (US), EPC (US), Analog Devices (US), and Hitachi (Japan).